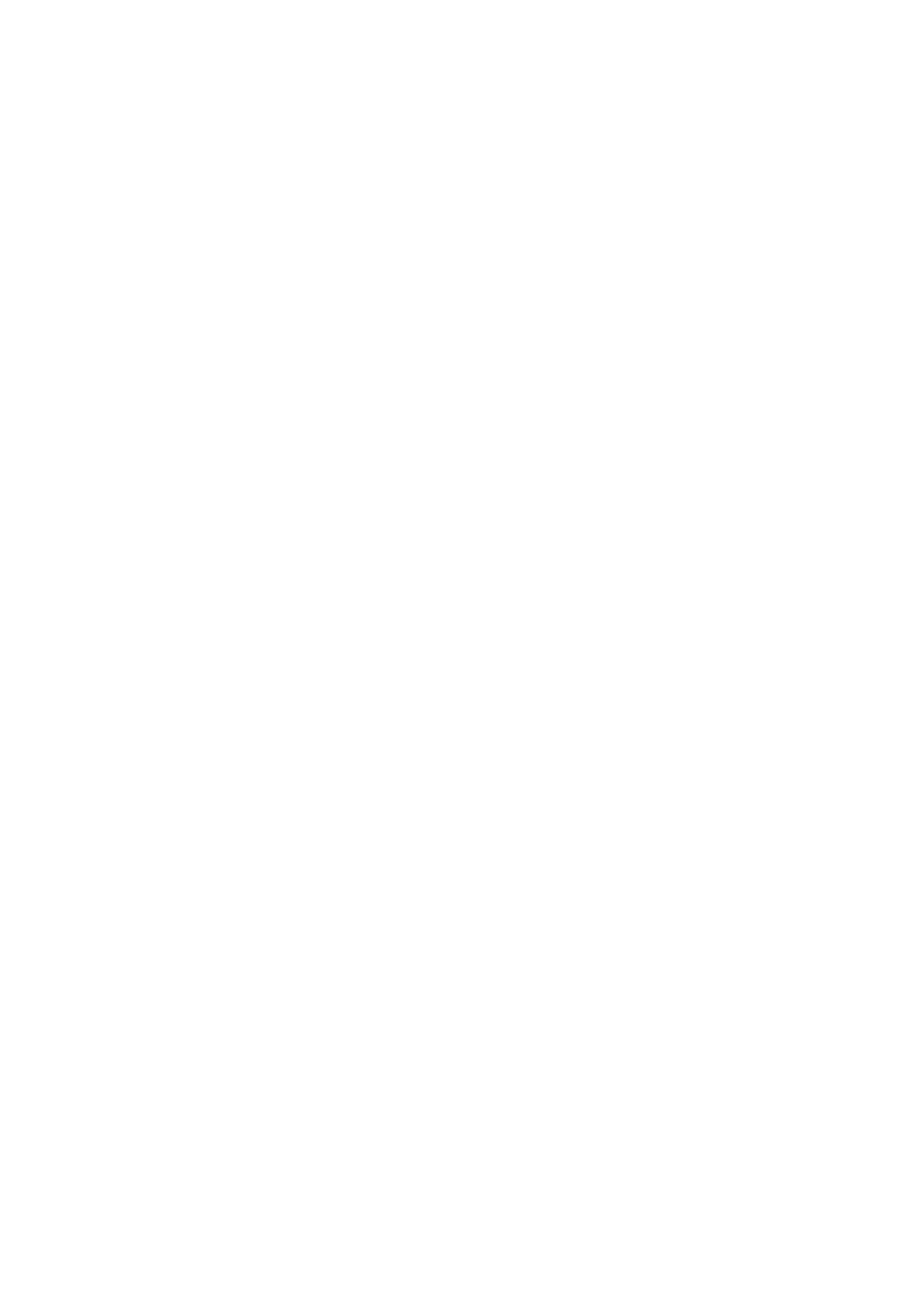

Customized investment policy creation and rapidity of execution are our standing points. We offer complete solutions and services for those seeking to set up or leverage their existing fund infrastructure through a full and open-architecture investment platform. We provide assistance in the take-on process, ensuring that the launch of new funds is quick and easy. The structure is a flexible option for fund managers, offering a turnkey solution that delivers all the necessary documentation and regulatory requirements. A sub-fund launch offers a cost-efficient and quick route to market, without the need to incorporate a stand-alone structure, giving solutions for:

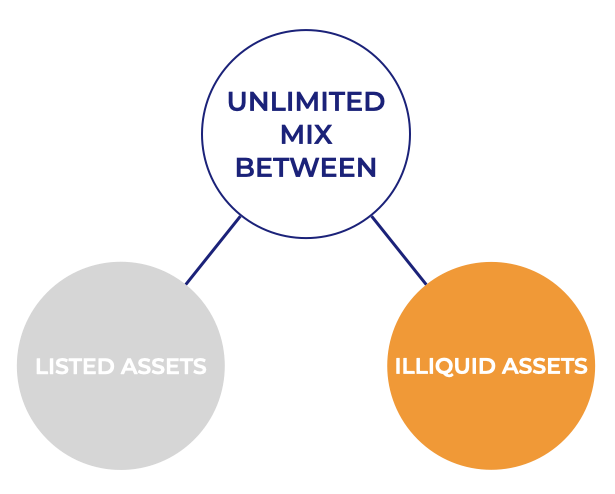

- Club-deal vehicle for illiquid investment

- Illiquid asset transformation

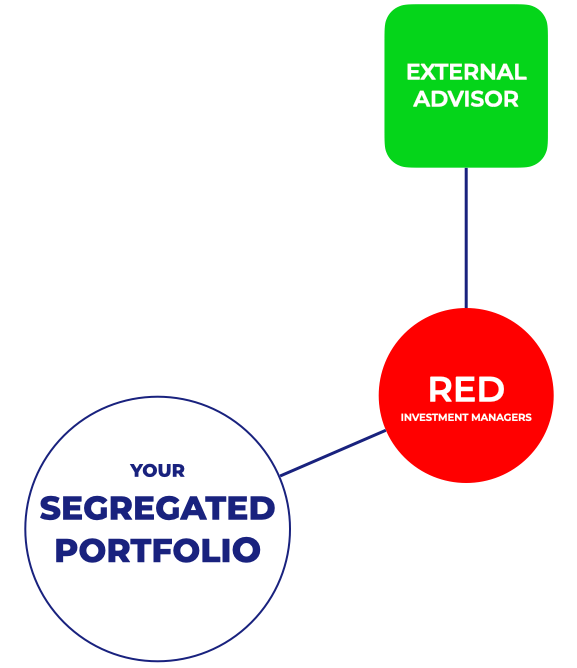

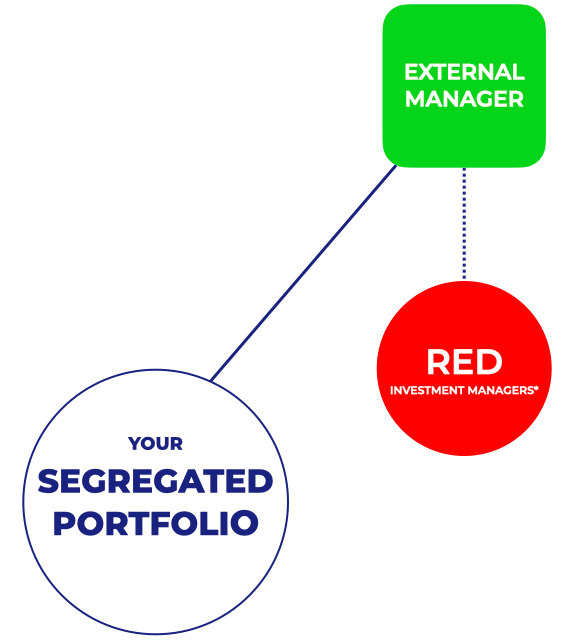

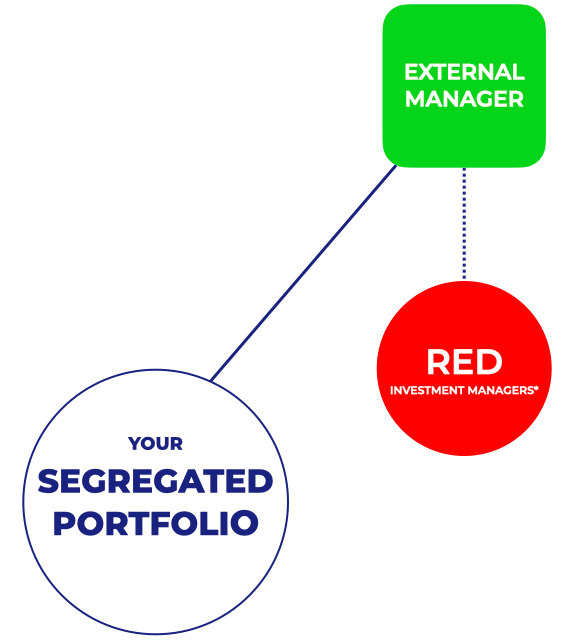

- Third-party managers

- Banks and Portfolio Managers

- Feeder Fund solutions

Key Benefits

Tailoring your existing strategy to our SPs framework becomes other than a daunting task, thanks to extensive and multi-layered experience in fund launches. Fund costs are tightly controlled, to make sure that the Total Expense Ratio (“TER”) is in line even with lower AUM. The Platform makes no claim on management, performance, or distribution fees. Managers keep the revenue they earn. The underlying administrative and legal structure is designed to have low impact. Each fund on the Platform is fully independent and segregated, making it a stand-alone product for the manager and its investors. The platform is also independent from large asset management companies, investment banks, group of interest, administrations, and legal structures.

* Redemption, subscription, NAVs calculation, and regulatory activity still being managed by RED Investment Managers Ltd.